Workplace Giving Platforms: 5 Ways You Can Boost CSR Success

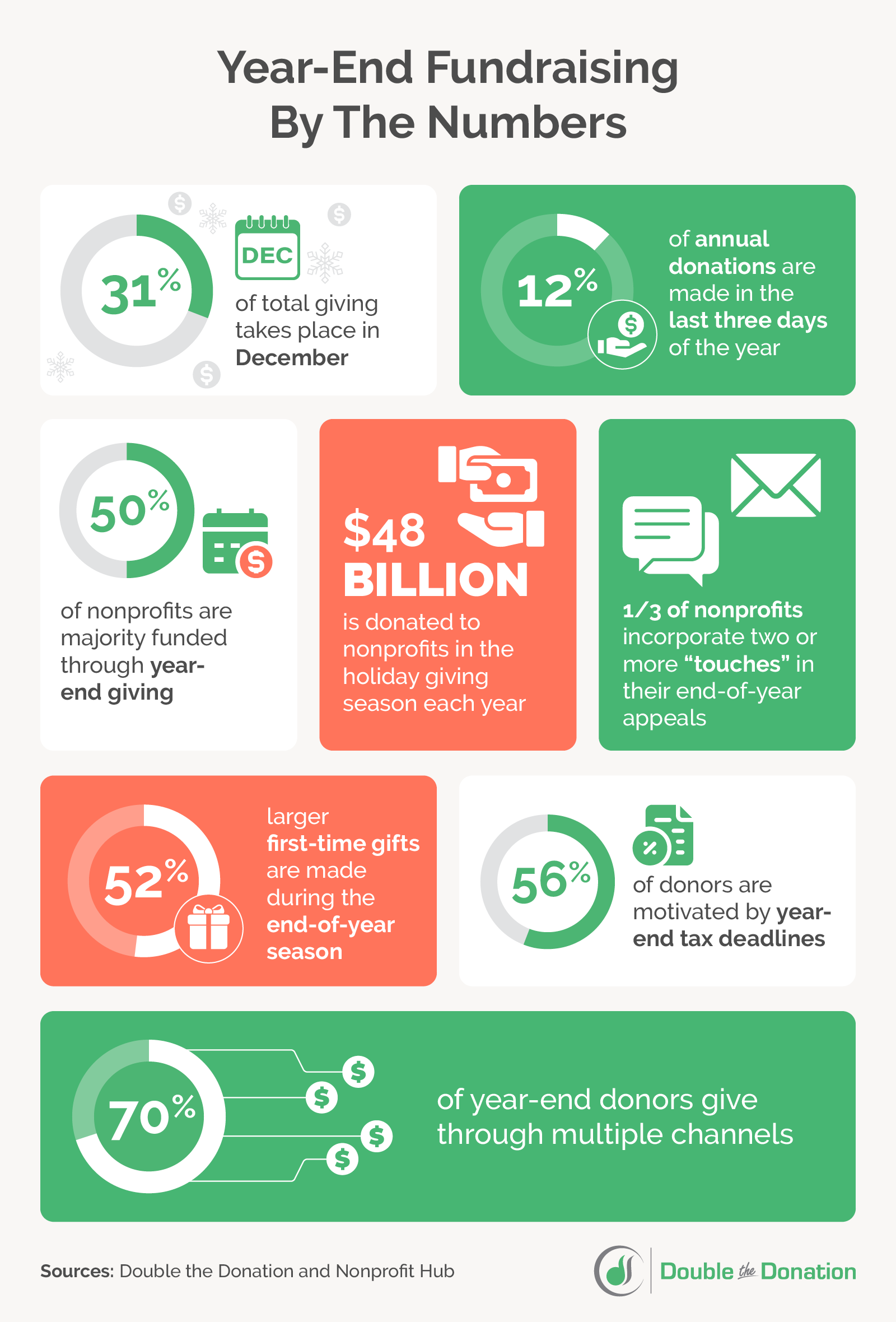

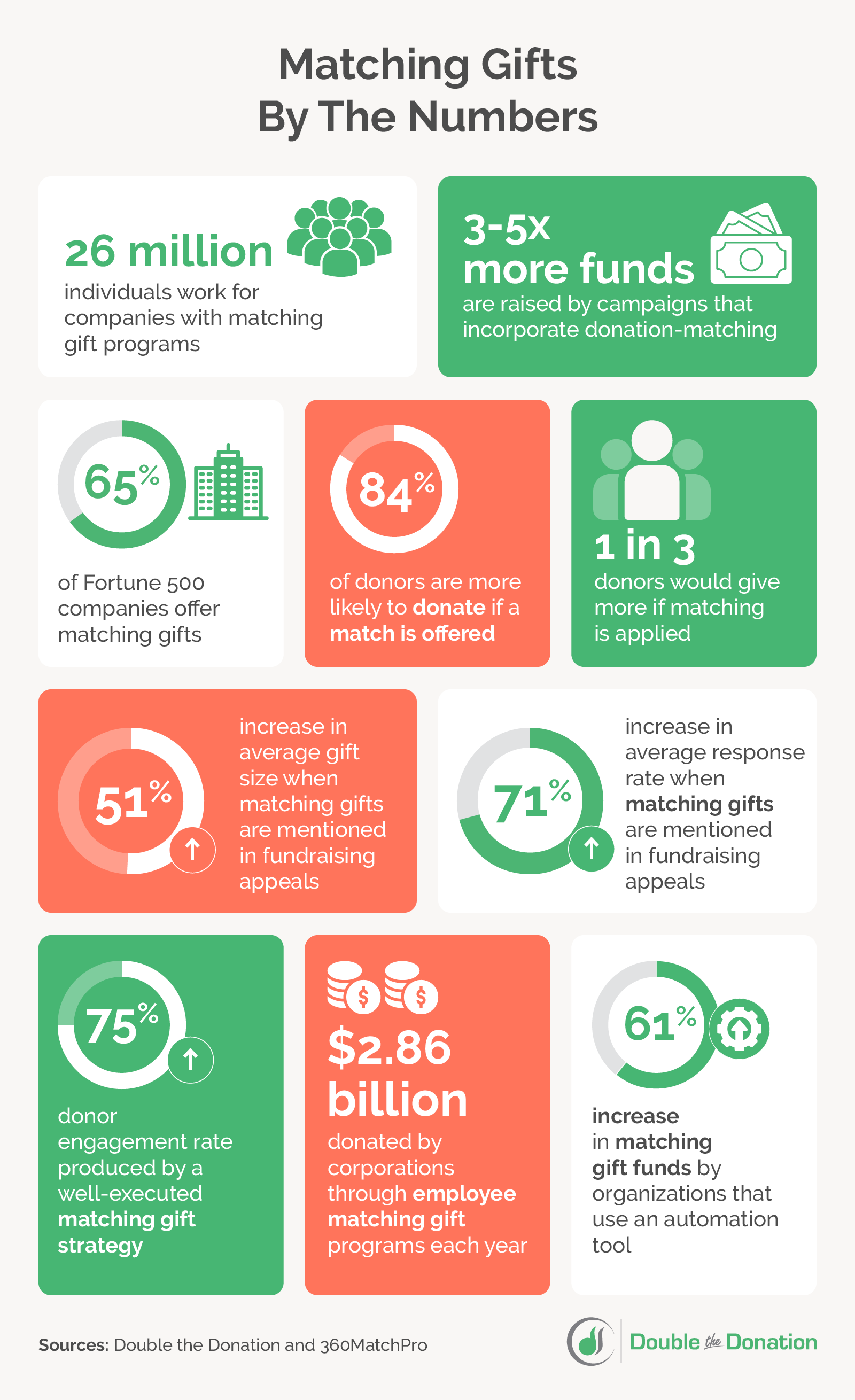

It’s no secret that corporate social responsibility (CSR) is on the rise. According to Double the Donation’s corporate giving statistics, 39% of companies plan to expand their workplace giving programs in the next two years, and CSR is growing in popularity across companies all over the world.

However, 78% of donors are unaware of their company’s program specifics, which is why workplace giving platforms are crucial to your company’s CSR success. We’ve created this guide to explore everything you need to know about workplace giving platforms, including:

- What are workplace giving platforms?

- 5 benefits of workplace giving solutions

- How to start using workplace giving platforms

- Workplace giving trends

When it’s easy for employees to participate in workplace giving programs, your company will do more than help its community. Employee engagement levels, your CSR reputation, and nonprofit causes will reap the benefits of an organized and streamlined process for managing workplace giving. With that in mind, let’s get started!

What are workplace giving platforms?

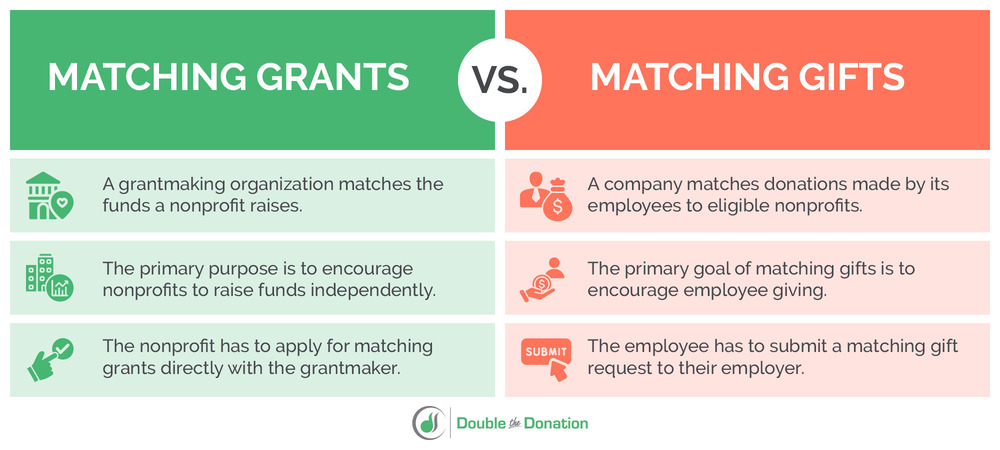

Workplace giving is an employer-sponsored program through which employees can donate to charitable causes in various ways, including matching gifts, volunteer grants, and automatic payroll deductions.

Depending on the type of program your company offers, you’ll have to facilitate different donation methods. For example, if you choose to offer volunteer grants, you’ll have to track employees’ volunteer hours. That’s where workplace giving platforms come into play.

Workplace giving platforms are software solutions that streamline a company’s corporate philanthropy efforts by managing giving and volunteering.

Using workplace giving tools, companies can efficiently manage their philanthropy programs, keep their employees engaged through easy participation, and boost the impact of their CSR initiatives. Let’s take a closer look at the ways workplace giving platforms can maximize your company’s CSR success.

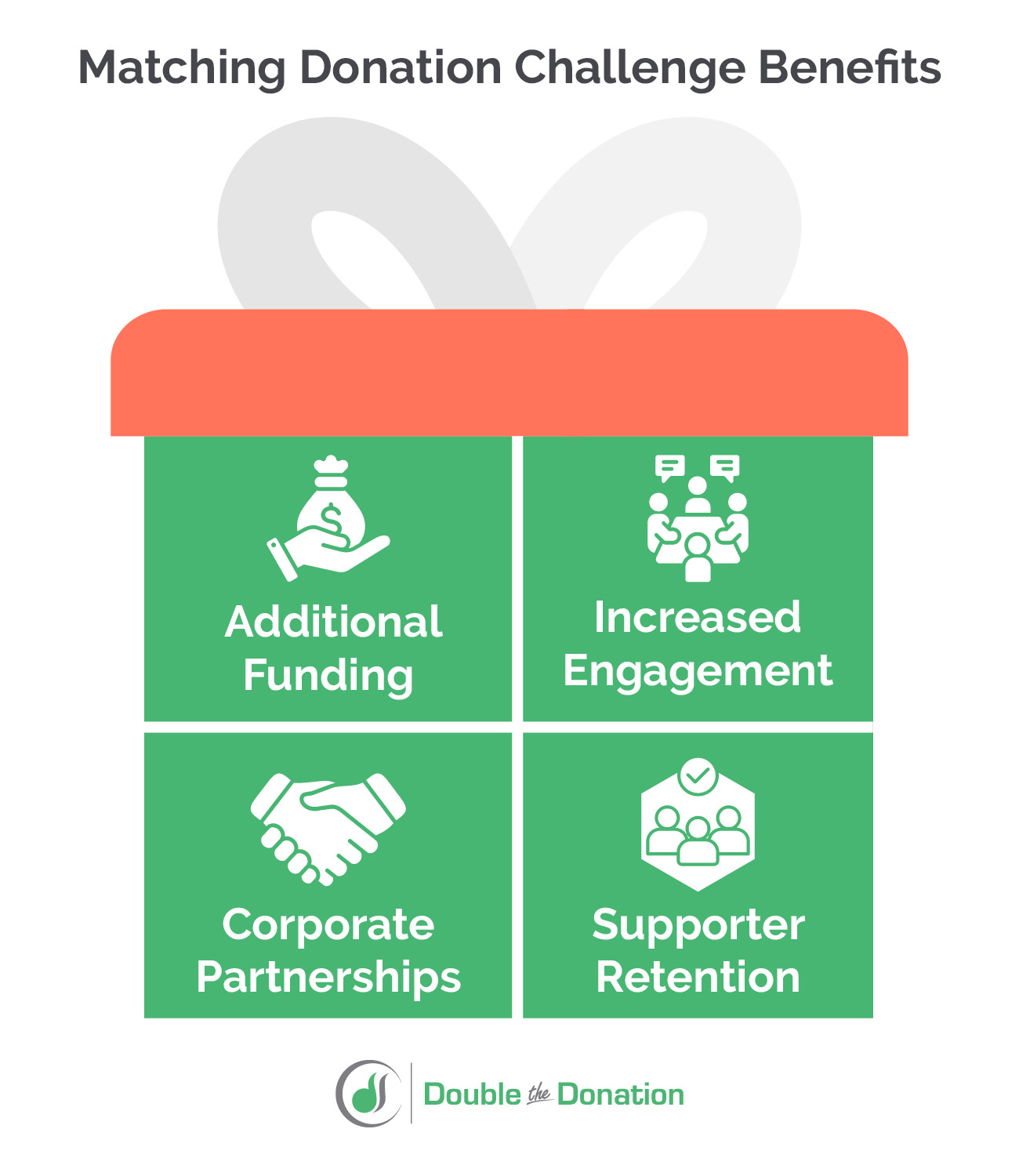

5 benefits of workplace giving platforms

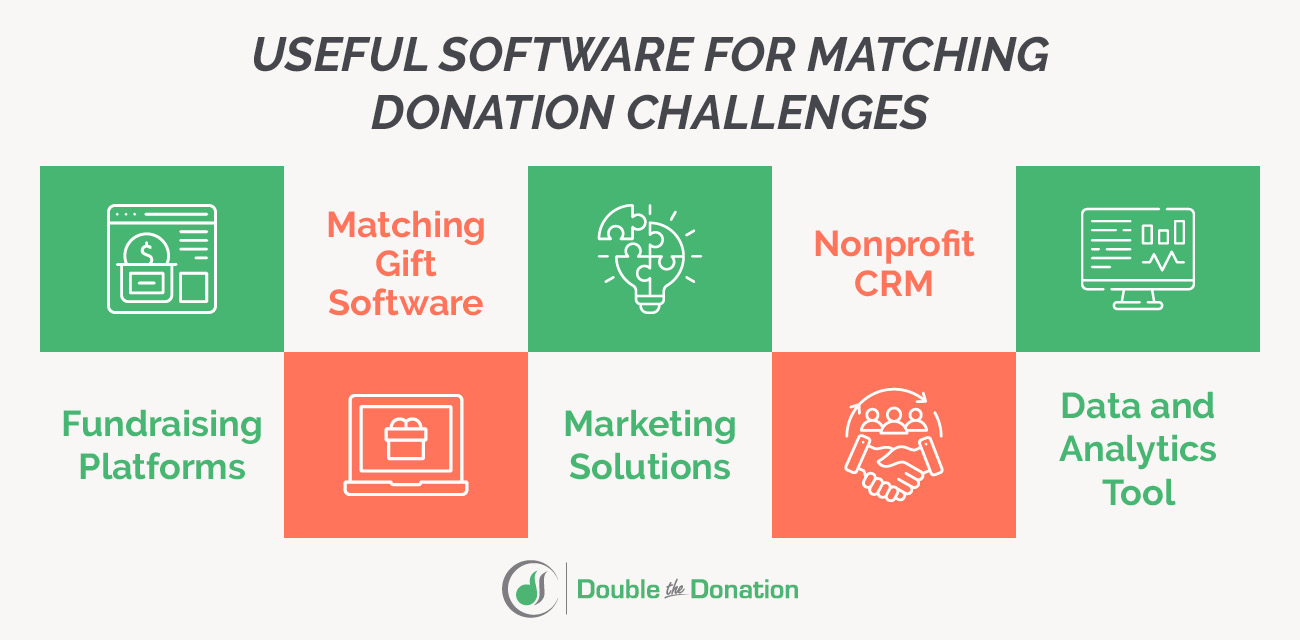

The type of workplace giving platform you need depends on the program your company runs, but there are software options for nearly every type of program. Let’s take a look at how specific platforms can benefit your company’s programs.

1. Matching Gift Management

Matching gift programs are one of the most common offerings companies have in terms of workplace giving.

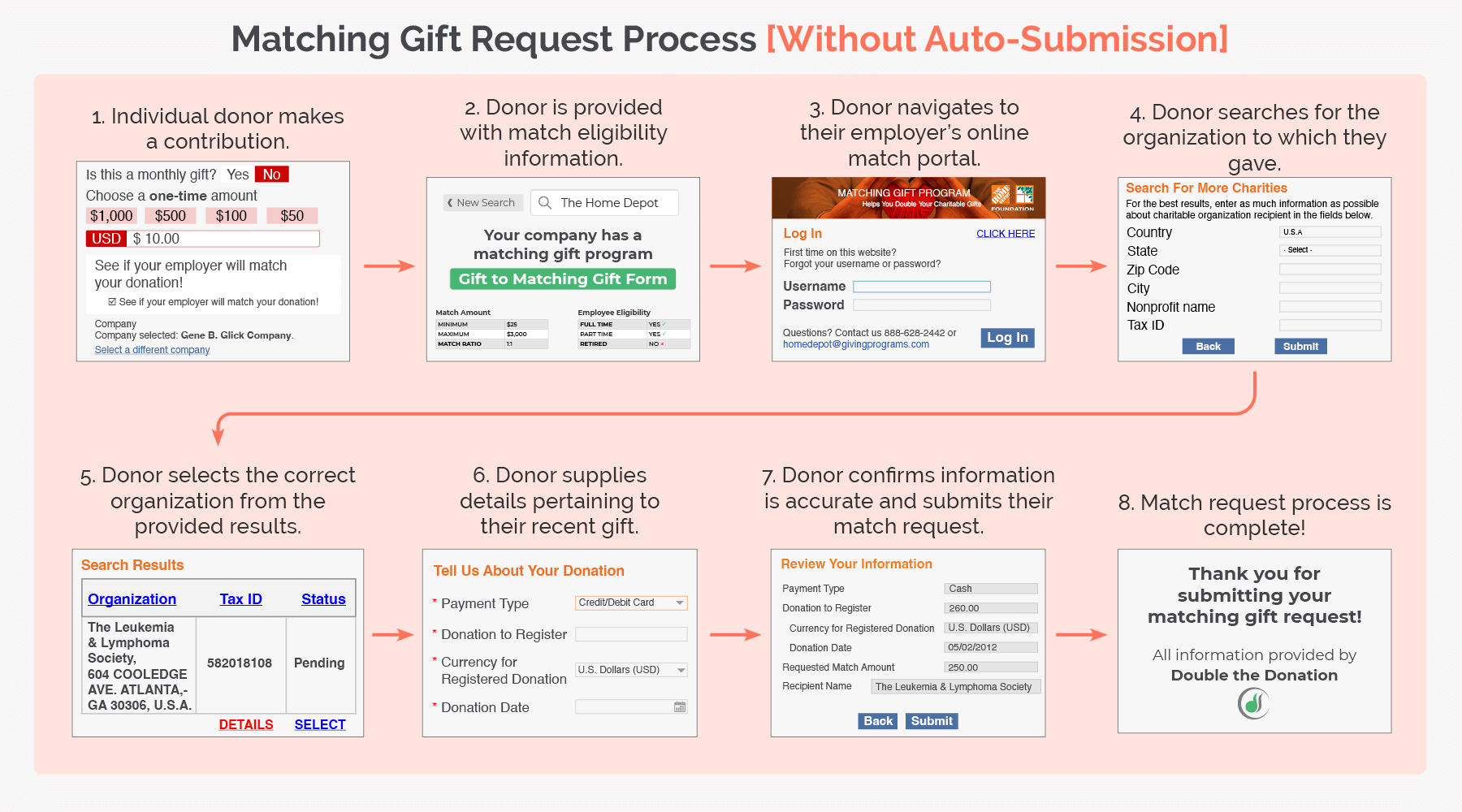

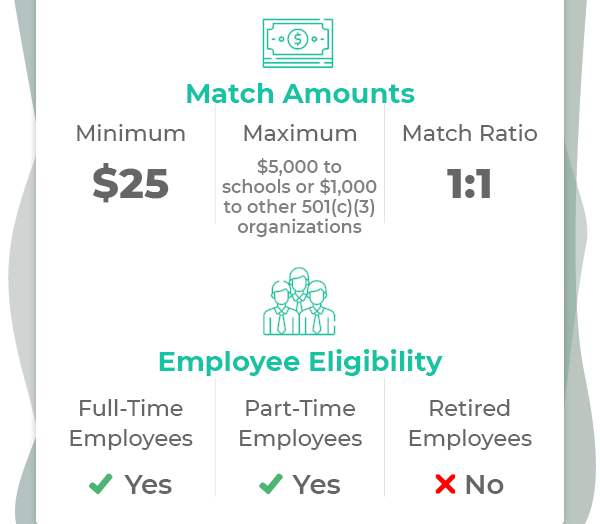

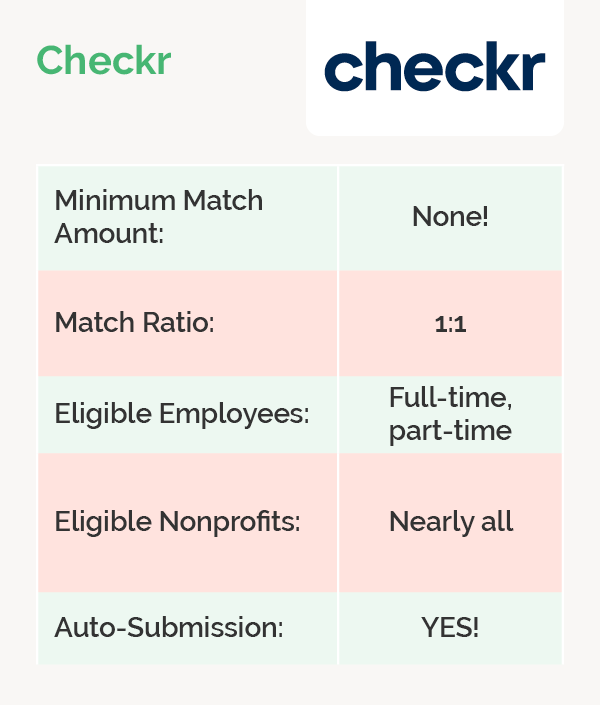

By essentially doubling the donations their employees make to eligible nonprofits (based on the company’s guidelines), companies benefit nonprofits and help their employees make a difference for the causes they care about. However, running a matching gift program takes a lot of organizational power, especially if your company has many participating employees and donations to track.

To make it easy for employees to participate, choose a workplace giving platform that allows you to:

- Track employee donations. Keep track of all employee donations in one central location so you can manage all of your incoming data more easily.

- Approve matching gift requests. Approve match requests automatically or with a single click based on minimum/maximum match amounts, eligibility requirements, and other guidelines your company has put in place.

- Engage your employees in giving. Engage your employees in the causes they care about by using a workplace giving platform that’s easy to navigate, flexible, and shows your company cares about giving back.

- Track your impact. Workplace giving platforms should offer robust, real-time reporting so you can keep track of the social good your company is doing.

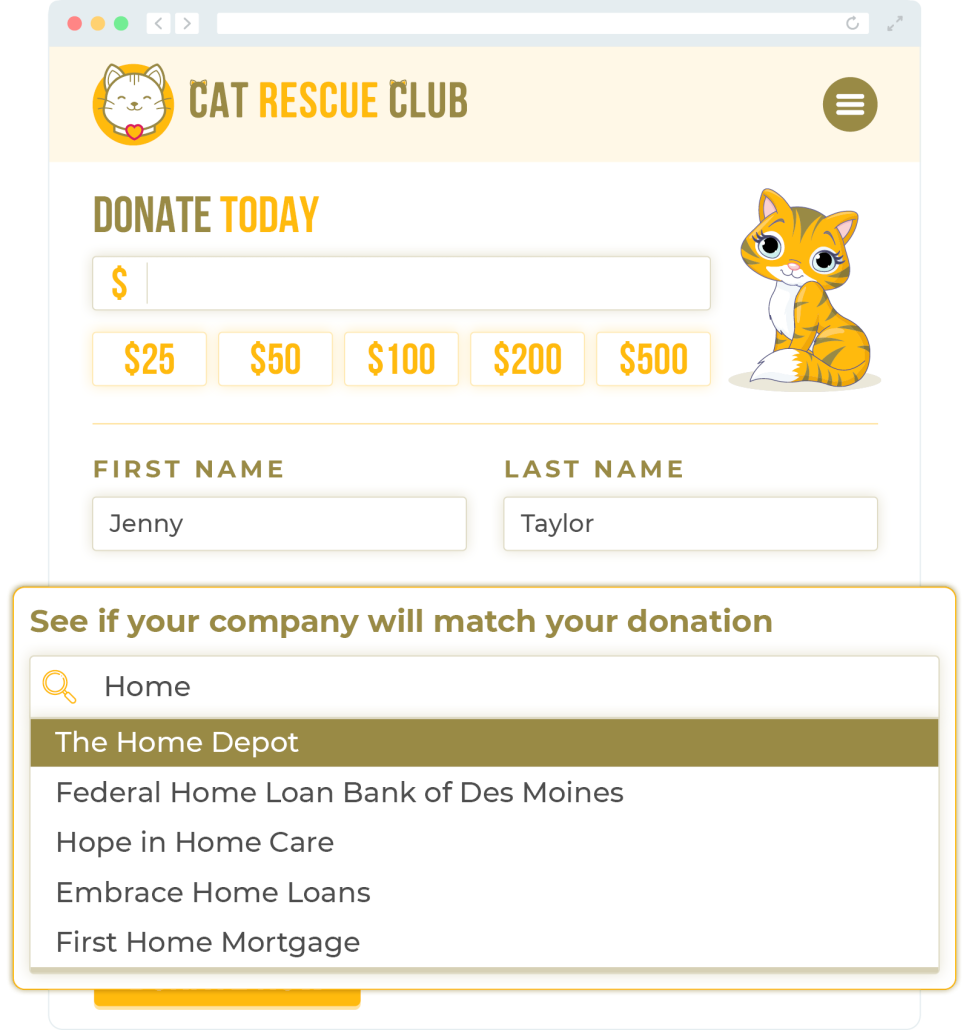

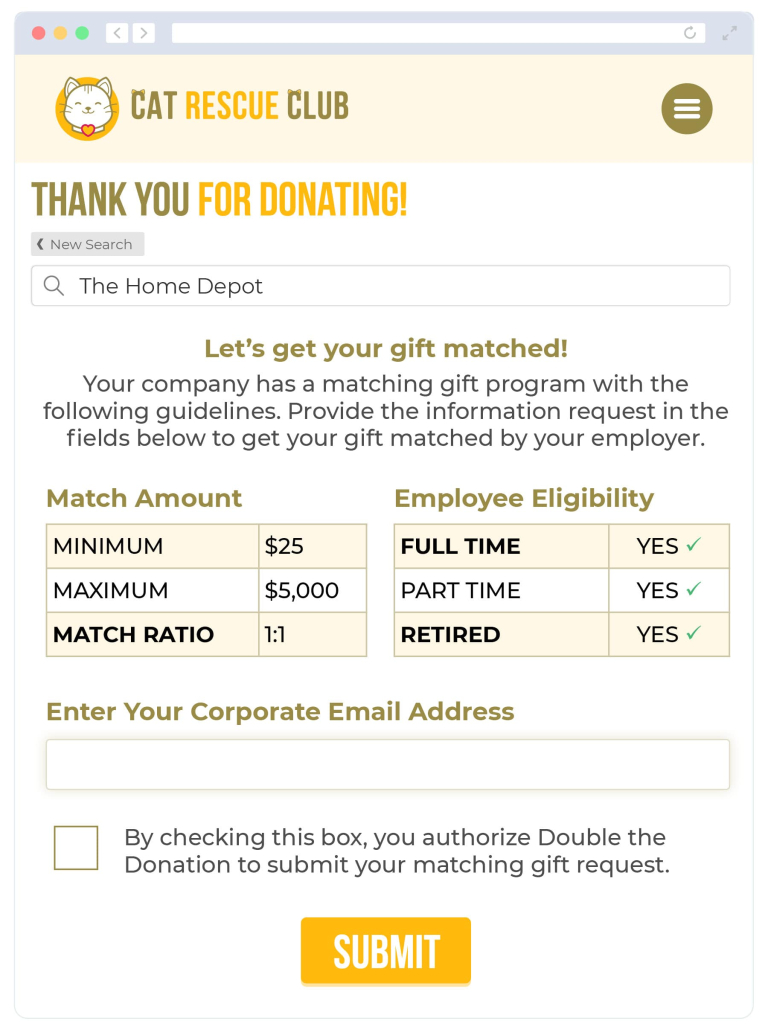

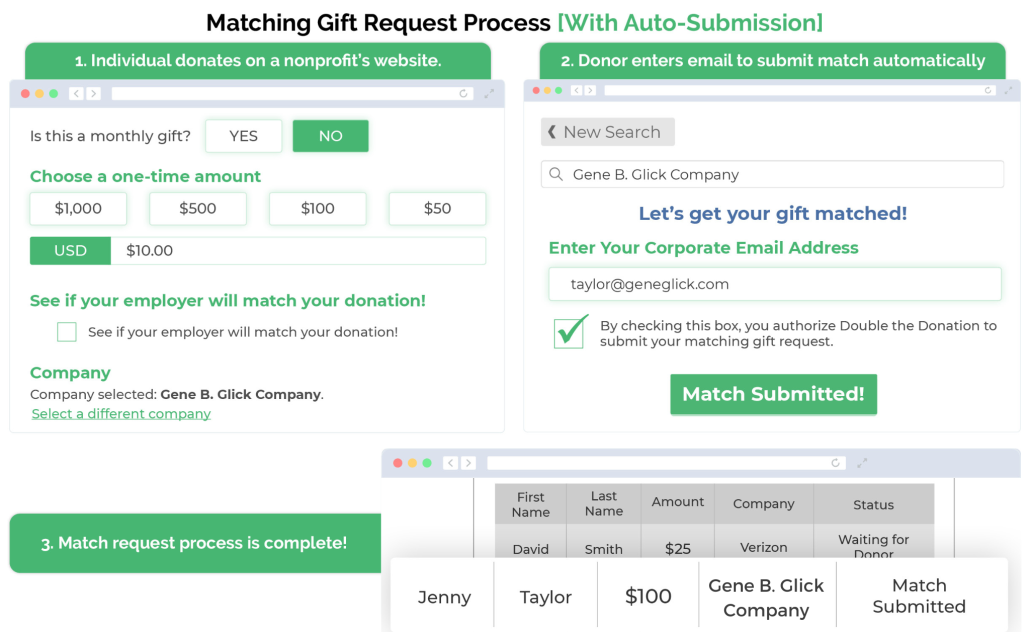

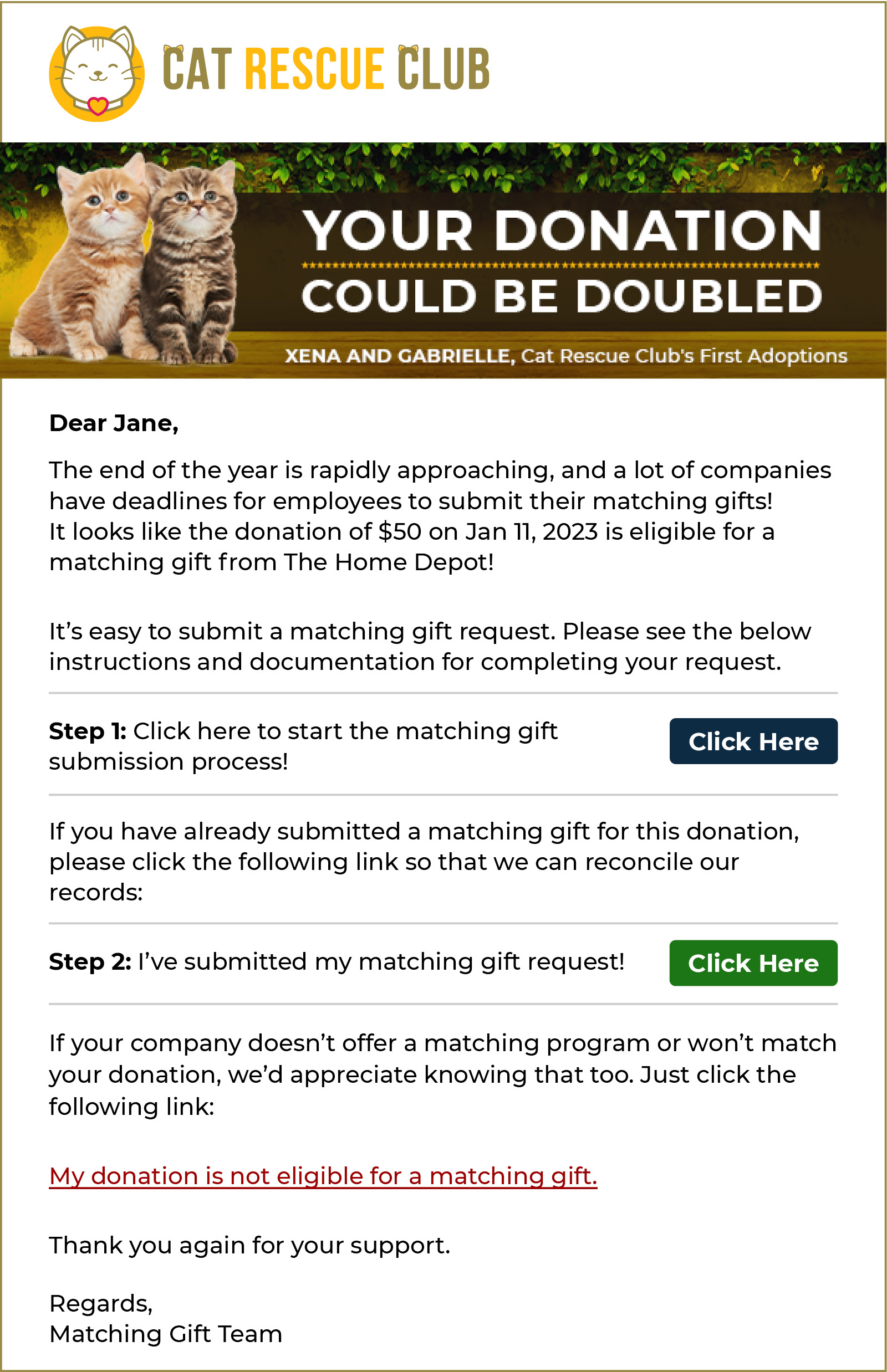

- Enlist matching gift auto-submission. Instead of requiring employees to complete a separate request process for matching gifts, some CSR platforms now offer innovative auto-submission functionality through a recently out-of-beta integration with Double the Donation’s tools. All it asks for is a corporate email address from the employee donor, and the software system processes the request from there!

The right workplace giving platform should help your company manage its matching gift program with ease, streamline your overall giving process, and encourage employee participation.

2. Volunteer Management

In addition to matching gift programs, corporate volunteerism is becoming a larger component of workplace giving. Volunteerism can take many forms, and as companies develop or expand their volunteer programs, the right workplace giving platform can keep them on track for success.

To dive deeper into the ways that corporate giving programs can manage volunteerism, we’re going to break it down into three categories: volunteer opportunities, volunteer tracking, and volunteer grants.

Volunteer Opportunities

The first hurdle your company may encounter when developing a corporate volunteering program is actually finding volunteer opportunities for your employees. Using a workplace giving platform that offers a database of both virtual and in-person volunteer opportunities can help you jump that hurdle easily and efficiently.

Workplace giving platforms vet the nonprofits in their databases, meaning your employees can rest assured that they’ll be working with reputable causes and organizations. Beyond sifting through nonprofit organizations for you, workplace giving platforms also help you create custom volunteer events for your employees, offering features such as:

- Planned shifts

- Event capacity planning

- Registrations

It’s great to get employees involved in your volunteer program, but it’s especially important that volunteers get to have a say in the opportunities available to them. That’s why offering a database of volunteer events is essential. Many companies also offer paid time off for volunteering (known as VTO), which gives employees a direct incentive to participate and increases employee engagement levels.

Volunteer Tracking

Once your volunteer opportunities have been confirmed, workplace giving platforms go further and allow you to track all elements of your employees’ volunteer efforts. This includes:

- Volunteer signups

- Logged volunteer hours

- Your overall impact

Employees can easily track their hours for any kind of volunteer event, while you can view all the wonderful work they’re doing from one central location.

Volunteer Grants

Another way to engage employees in corporate volunteerism is by offering volunteer grants, which are monetary grants awarded to nonprofits in response to employees’ volunteer hours with that organization.

Like with matching gift programs, workplace giving platforms help you monitor volunteer grant requests that come through. As employees track their hours and request grants, you can easily approve and process each request in the same central system—much like you would with matching gifts.

All of these components of volunteer programs are important. Whether you’re offering VTO, trying to make it easy for employees to find volunteer opportunities, or processing volunteer grant requests on a regular basis, workplace giving platforms take the extra legwork out of the equation.

3. Additional Workplace Giving Program Management

Of course, workplace giving is made up of more than just matching gifts and volunteer programs. There are tons of different programs that contribute to CSR, and choosing the right workplace giving solutions can help streamline all of them.

Workplace giving platforms can help you manage:

- Automatic payroll deductions: Workplace giving platforms with payroll integrations and features allow employees to select a nonprofit from a large database of pre-vetted 501(c)(3) organizations. From there, they can choose to set up a recurring deduction through the platform for as long as they’d like.

- Disaster relief: Workplace giving solutions often offer tools to quickly create new disaster relief campaigns. After all, the faster companies can launch a campaign, the faster they’ll be able to collect and disburse funds to nonprofits in need.

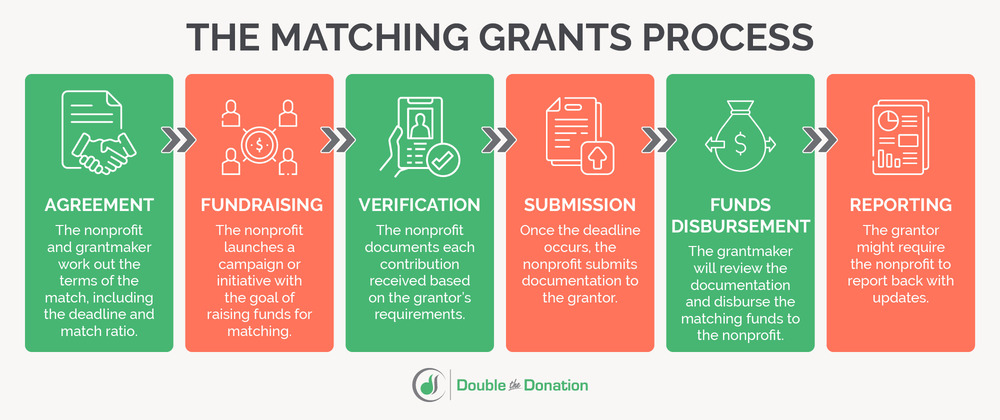

- Grant management: Many companies and foundations provide annual grants to important causes and organizations around the world. Workplace giving platforms can help grantmaking organizations manage all aspects of the grantmaking process, including grant proposals, approvals, budgets, and goals.

Workplace giving platforms also help companies build a community within their teams by supporting causes that are important to them.

Use a workplace giving platform to set goals, select nonprofits, spotlight volunteer opportunities, and more. These tools allow you to create a sense of urgency and keep your employees engaged in nonprofit causes and events all year long.

4. Employee Engagement

Whether you’re running a grant program, launching an employee giving campaign, offering payroll deductions, or starting other types of workplace giving programs, choosing the right solution to meet your company’s needs will benefit more than just your team and your brand. It will also deeply engage your employees and strengthen your company’s workplace culture.

Here are a few ways your workplace giving platform can engage employees:

- 90% of employees are more motivated and loyal who work at companies with a strong sense of purpose. When you invest in software that standardizes the process for getting involved in workplace giving, your program will become a central part of the workplace culture. That way, employees will know your company is serious about making a difference.

- 87% of corporate leaders believe their employees expect them to support causes and issues that matter to them. Workplace giving platforms, like matching gift databases, can help employees determine their eligibility for certain programs and contribute to the nonprofits of their choice. This encourages employees to support the causes they care about—and lets them know your company is behind them all the way.

- Nearly 70% of employees wouldn’t choose to work with a company that lacks a strong sense of purpose, and 60% would take a pay cut to work for a purpose-driven company. By leveraging workplace giving platforms, your company can effectively spread the word about its giving opportunities and standardize the process for getting involved.

It’s clear: Employees are more dedicated to companies that support charitable giving, and workplace giving platforms can help you show your support by simplifying the giving process! Check our list of employee engagement ideas to learn more.

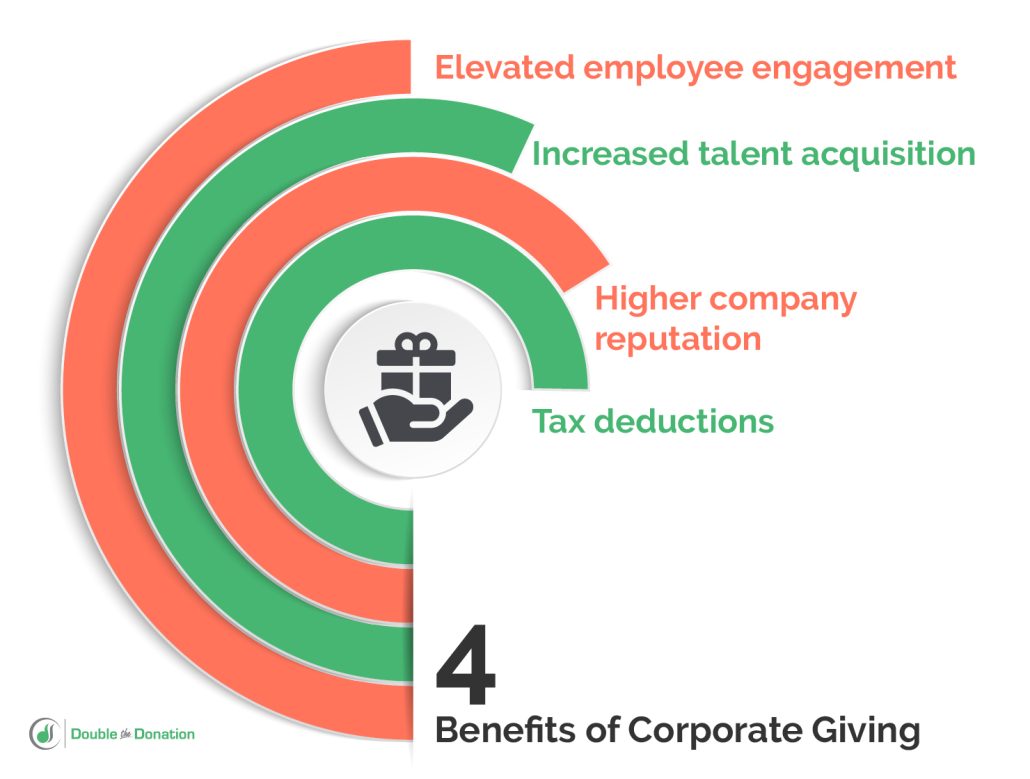

5. Company Reputation

According to NonprofitsSource’s guide to workplace giving, an established giving program can enhance your reputation in the community. And just as your workplace giving platform plays an important role in your program, it also has a large impact on your brand reputation!

Use your solution to:

- Demonstrate your commitment. Having a workplace giving program in place is one thing, but investing in software to promote and streamline the process demonstrates a deep level of commitment to charitable giving. When you invest in a dedicated workplace giving platform, employers and community members alike will know your company is committed to making a difference.

- Measure your impact. Your workplace giving platform may offer tools for tracking and reporting the impact of your program through metrics like employee volunteer hours and dollars donated. Use these features to share the tangible impact your company makes

- Partner with nonprofits. With the right tools, your company can pair its workplace giving platform with nonprofits’ solutions to maximize donations and raise awareness about your program. For example, if your platform integrates with Double the Donation, you can allow employees to automatically submit matching gift requests on a nonprofit’s website. This raises awareness of your program among nonprofits, which may lead to future partnerships and endorsements.

Workplace giving and improved company reputation are components of a cyclical strategy to increase the impact your company makes. Your efforts to give charitably will enhance your brand reputation, which will recruit more customers and supporters for your company. In turn, you’ll receive more resources to invest back into your workplace giving program, making a greater impact overall.

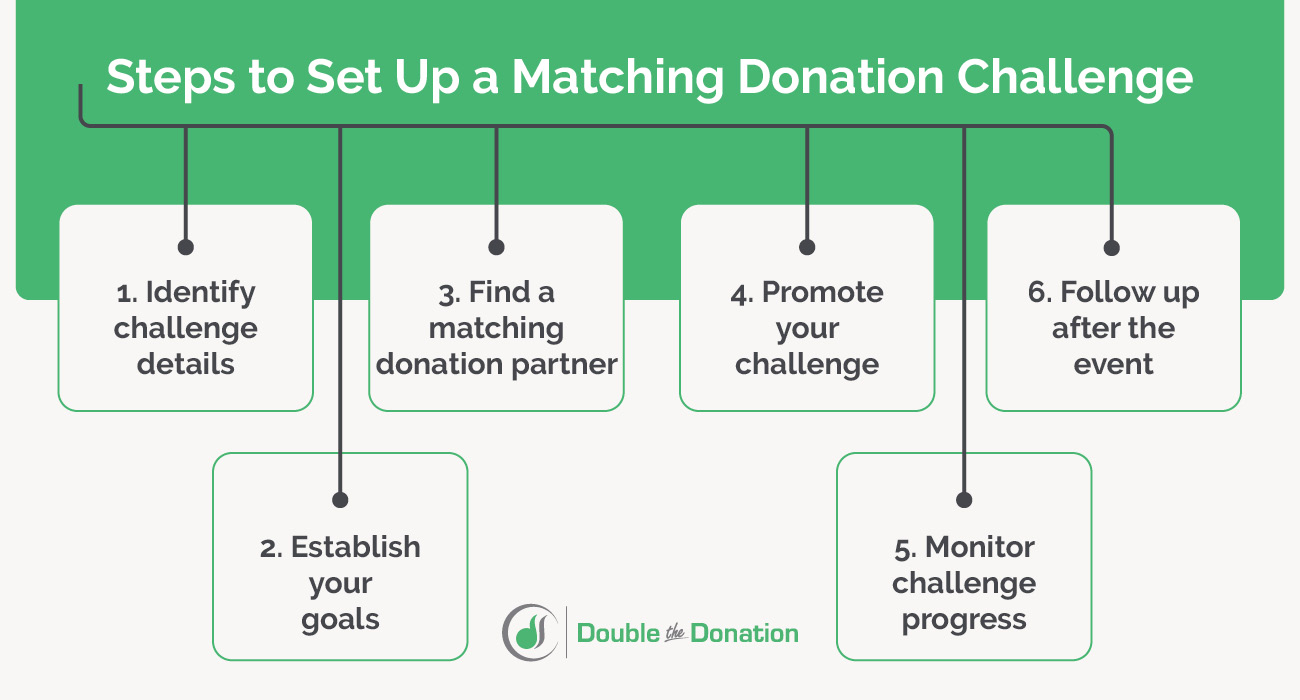

How to start using workplace giving platforms

1. Determine your needs

To start using workplace giving platforms, you’ll first need to decide which solution makes the most sense for your company. When researching platforms, consider the following:

- The software’s capabilities: Make a comprehensive list of the tool’s features and determine which ones you’ll use the most. Which features do you need in a platform for your specific giving program?

- The vendor’s reputation: Check reviews for the provider of the software. For further insight, you can ask other company leaders for their feedback on platforms they’ve tried.

- Ease-of-use: Request a demo of the platform to familiarize yourself with how it’s used. That way, you can determine if you’re comfortable with the tool and how easy it will be for employees to access it, as well.

Don’t shy away from any questions you have for the software provider or during the demo. After conducting thorough research, choose a platform and get started!

2. Educate employees

Your employees are a key part of your workplace giving efforts—after all, their giving is often the first step in your company taking action to give charitably.

Create training materials to go over the platform (and your giving program) with employees. Teach them how to use the platform and how to make the most of your workplace giving programs.

Be sure to incorporate informative materials about workplace giving in new employee onboarding, as well. This ensures that every employee learns about workplace giving from the very beginning of their tenure with your company, maximizing the potential of their giving.

3. Promote your program

Leverage your company’s most frequently used communication channels to promote your workplace giving program, including social media, your website, email newsletters, and any other messaging platforms you use. This not only puts your program in front of employees but also garners the attention of nonprofits, which may partner with you after seeing your commitment to workplace giving.

Workplace giving trends

Interested in exploring new and upcoming trends surrounding workplace giving and the technology that empowers it? Staying on top of changes in the industry can help you ensure your team is equipped with the best tools possible.

Here’s what we’ve seen recently:

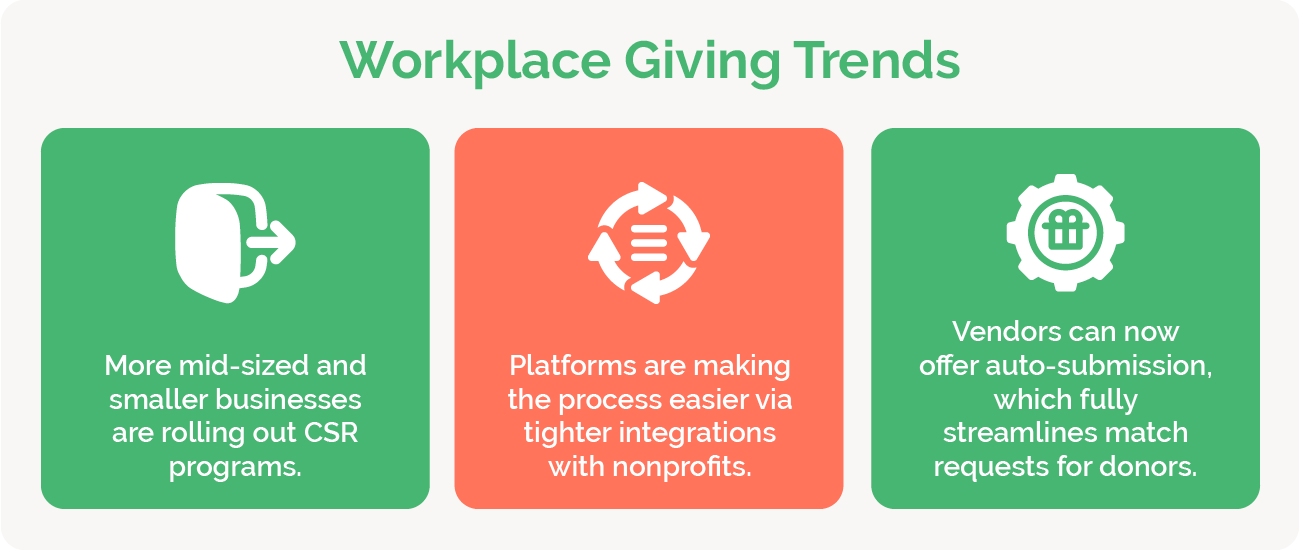

1. More mid-sized and small businesses are rolling out CSR programs.

Historically, workplace giving programs such as matching gifts, volunteer grants, and more have been primarily offered only by the largest businesses.

Now, these types of programs are becoming more accessible than ever for mid-sized and small businesses as well! Why? For one thing, the sector’s been seeing increasingly flexible pricing scales for workplace giving platforms, making streamlined management more attainable for companies of all shapes and sizes.

Not only that, but new corporate giving vendors are entering the game with a specific focus on targeting mid-level businesses. This takes a lot of the administrative burden away from company leadership itself, meaning more corporations are willing and eager to roll out the programming.

If you’d like to be inspired by some small and mid-sized businesses with big workplace giving programs, take a look at these examples:

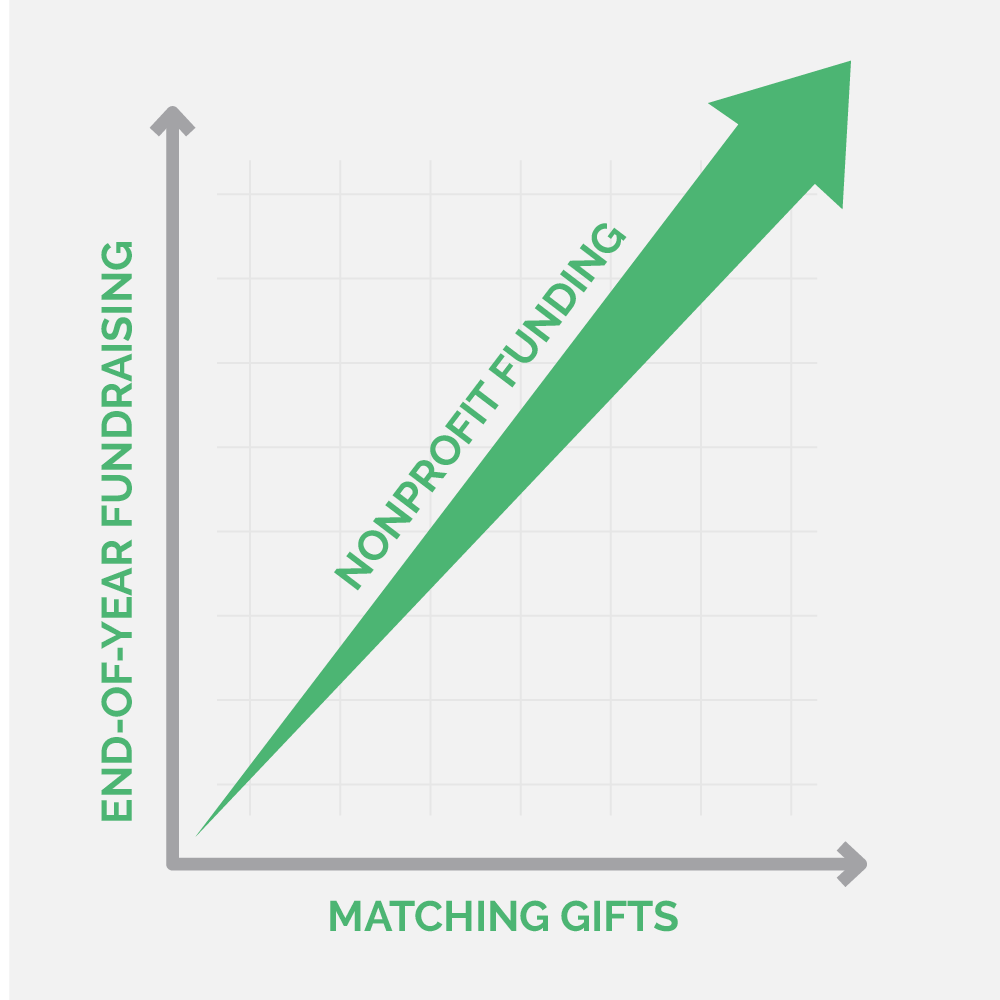

We love seeing new companies establishing and growing their workplace giving—whether through matching gifts, volunteer grants, or other engaging initiatives for employees. In the end, it means more nonprofit funding, more workplace engagement, and more socially responsible businesses powering good in our communities. We’re excited to find out which companies are next!

2. Workplace giving platforms offer tighter integrations with nonprofits.

Corporate philanthropy programs essentially form partnerships between companies and nonprofits. Workplace giving programs take things a step further, empowering companies to directly support the organizations that their employees are already giving to.

Because a significant prerequisite to workplace giving success has to do with employees engaging with the nonprofits—and submitting their workplace giving requests with their employers—in the first place, it’s essential that companies focus on ensuring a seamless process for doing so.

Workplace giving platforms know this, and that’s why they’re aiming to make the process of using their software as quick and easy as possible for both their corporate clients and, particularly, for their clients’ end users: employees. A huge part of that involves developing tighter relationships with the nonprofits on the receiving end of the programs.

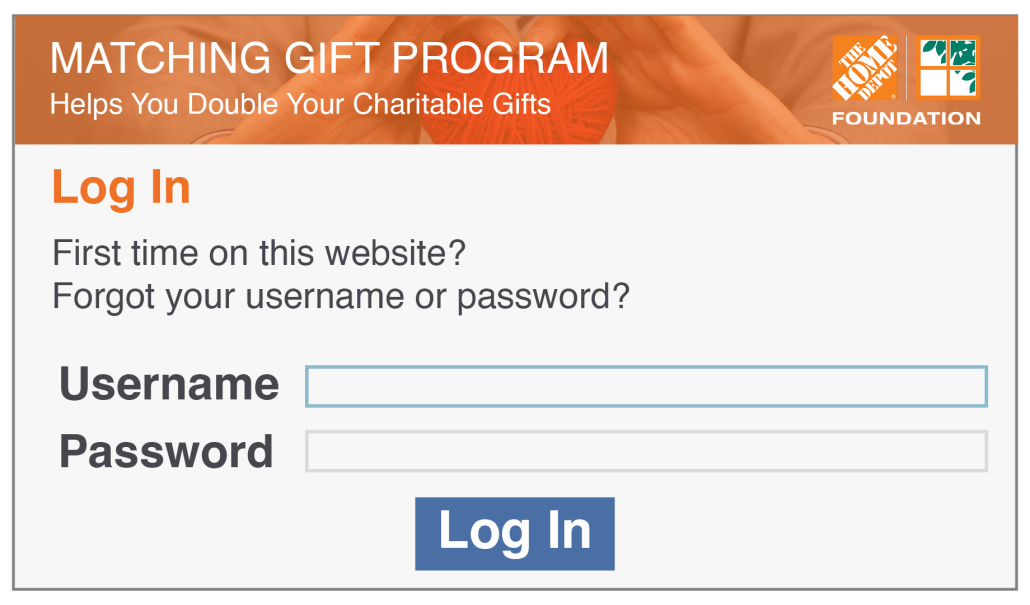

For example, though software providers are focused on selling their tools to corporations offering workplace giving programs, most have built out separate nonprofit management portals with which organizations can facilitate their end of the workplace giving process. Within these nonprofit-specific portals, organizations can easily go in and verify individual donations, volunteer hours, etc., in order to move the requests to the next step. And this end of the platform is typically free for nonprofit causes, helping to further build those relationships through streamlined and accessible technology.

Plus, offering tighter integrations with nonprofits helps make the employee and donor experience more optimal as well. When an organization has already established an account with the workplace giving platforms their supporters use, individuals can typically complete their request process more easily—for instance, having the ability to select from a search of pre-approved organizations rather than having to input all the information for the cause from scratch.

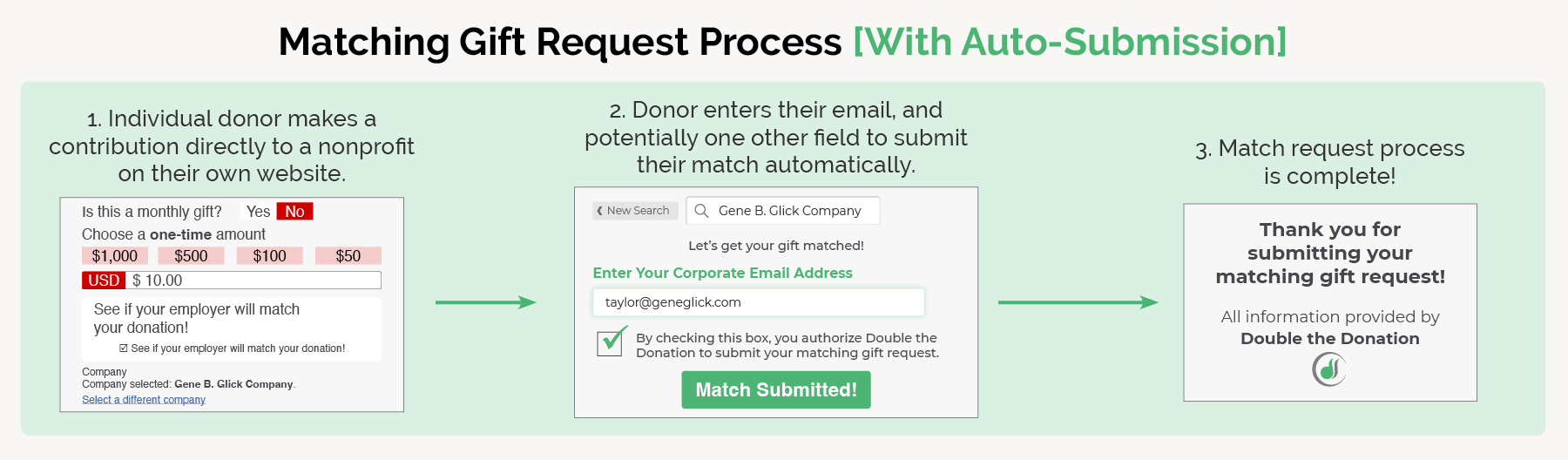

3. Vendors can now offer auto-submission, which fully streamlines match requests for donors.

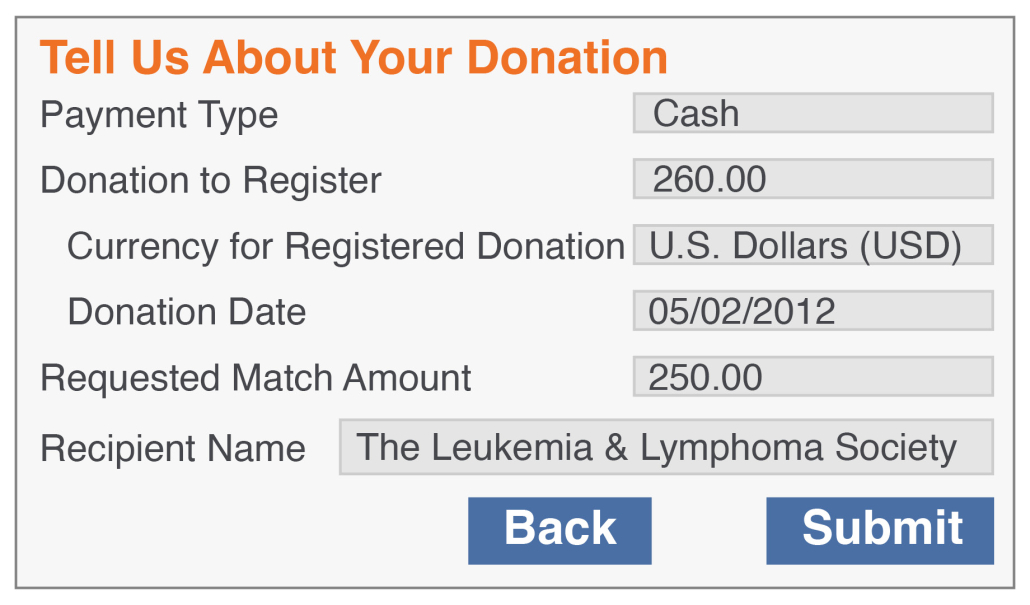

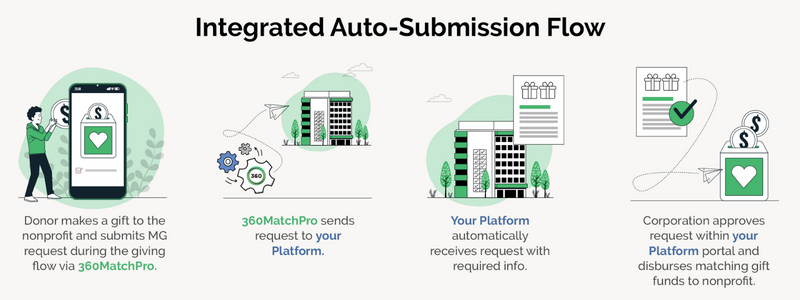

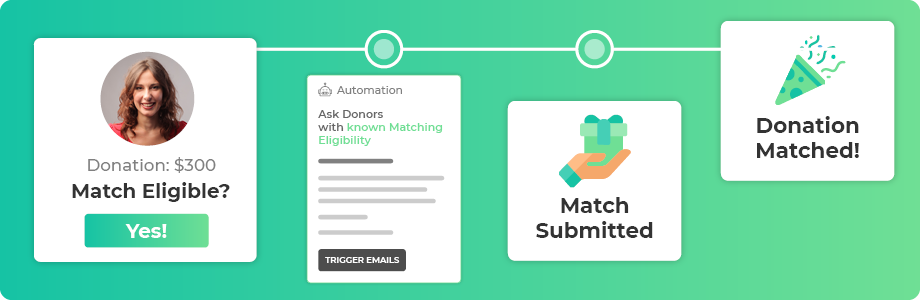

In order to provide workplace giving technology that truly streamlines and simplifies matching gift programs for donors, nonprofits, companies, and employees, some providers have rolled out brand-new auto-submission functionality, which recently completed its beta testing.

Individuals can now submit their matching gift requests to their employers with a single click directly from the donation confirmation pages of the organizations they support. All they have to do is enter their corporate email address and check, “Yes, submit my matching gift request!”

This video explains how it works.

Now, this helps in a few key ways. For one, it enables organizations to capitalize on donors’ giving momentum right when they’re at their highest level of engagement with the cause: while giving. It minimizes the risk of them saying, “Oh, I’ll do that later,” and then never coming back to it.

Not to mention, it also significantly decreases the amount of time and effort required of a donor to complete the process. Whereas a donor may have previously been asked to provide information about themselves, their donations, and the organizations to which they give, now all they need is an email address. The software ecosystem handles the rest of the data behind the scenes!

This simplicity helps in a few key ways:

- Nonprofits can drive more revenue. Organizations can capitalize on donors’ giving momentum when they’re at their highest level of engagement with the cause: while giving. It minimizes the risk of them saying, “Oh, I’ll do that later,” and then never coming back to it.

- Donors can breeze through the request process. Auto-submission decreases the amount of time and effort required of a donor to complete the process. A donor may have previously been asked to provide a variety of information about themselves, their donations, and the organizations to which they give. With auto-submission, all they need is their work email address. The software ecosystem handles the rest of the data behind the scenes!

- Companies can easily approve match requests. When automatically filled out, forms will have fewer (if any) errors compared to when filled out manually. That means less back and forth, so companies will experience a streamlined approval process.

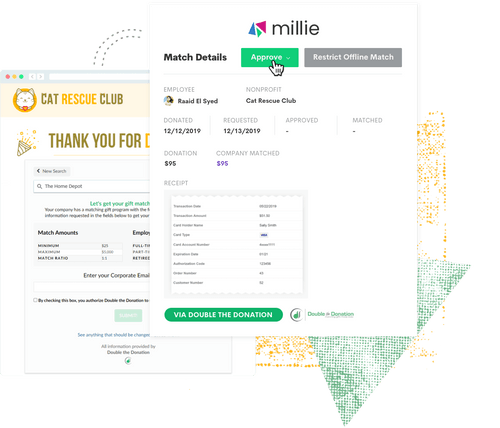

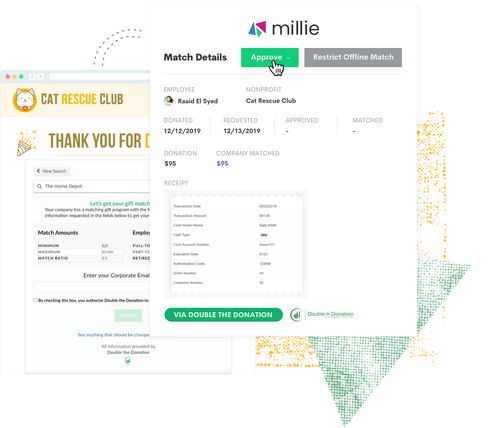

At this time, auto-submission functionality is made available through workplace giving platforms that integrate with Double the Donation’s matching gift tools. Currently, this includes these corporate giving software providers:

- Millie

- Selflessly

- POINT

- And more!

That means that when an employee works for a company outsourcing their workplace program management to a CSR vendor like Millie, Selflessly, or POINT, they are already eligible to participate in auto-submission. That is, as long as the organizations they’re giving to also employ Double the Donation’s software.

But auto-submission remains a rapidly growing innovation; with the solution now out of beta, it will will soon incorporate many more corporate vendors (and their clients), companies (and their employees), and nonprofits (and their donors). And we can’t wait to watch all the matching gift requests being processed when they do!

Additional Resources on Workplace Giving Platforms

If you’re looking for more information about workplace giving and the platforms that can help you be successful, check out the additional resources below:

- Workplace Giving: The Guide for Nonprofits and Companies. Looking for a primer on workplace giving? Here’s an easy rundown of how it works for both nonprofits and companies.

- Top Corporate Giving Software to Drive Employee Engagement. Want to drive up your employee engagement with corporate giving? Here’s a list of the top corporate giving software you can use.

- Matching Gift Software Vendors: The Comprehensive List. Matching gifts are important for nonprofits and companies. Here are the top vendors you can use to make the most of this program.