It’s Never Too Late for Donors to Submit Matching Gift Requests

Are you just jumping on the matching gift bandwagon? Worried about having to build a program from the ground up with all new donations?

Fear not, many of your past donors are still eligible for matched gifts.

Matching gifts don’t have to be submitted immediately after the donation is made. Although, it is to your benefit to encourage your donors to make the request as soon as possible because:

- The farther from the donation a supporter gets, the less likely he will be to follow-up with a matched gift

- The sooner your nonprofit receives the extra funds, the sooner it can put those funds to good use

Matching gift deadlines vary by company, so there’s still time to promote matching gifts to donors who contributed to your organization this year.

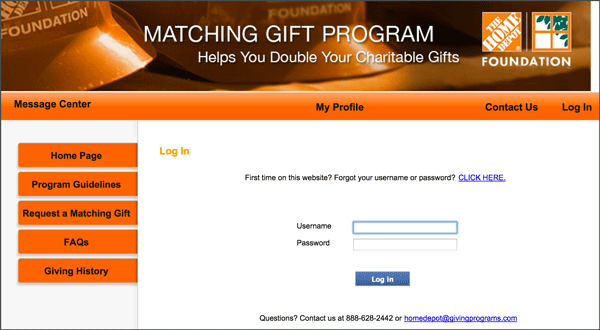

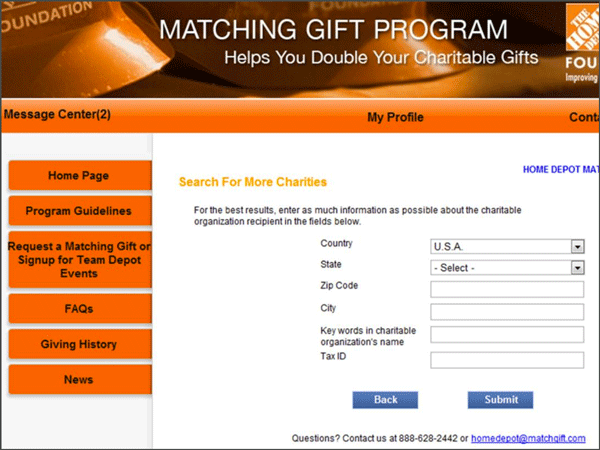

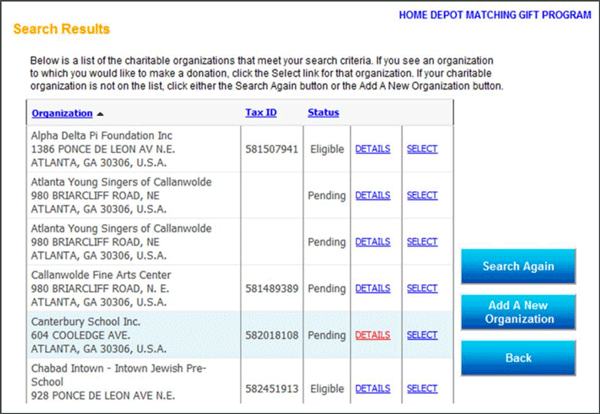

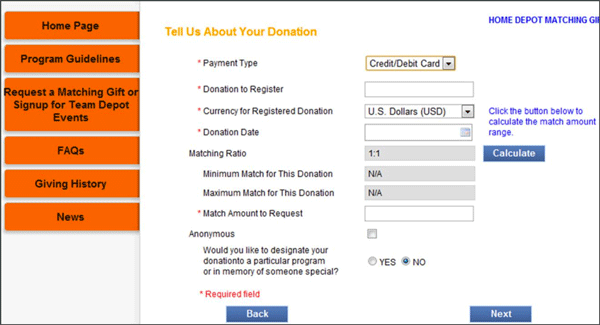

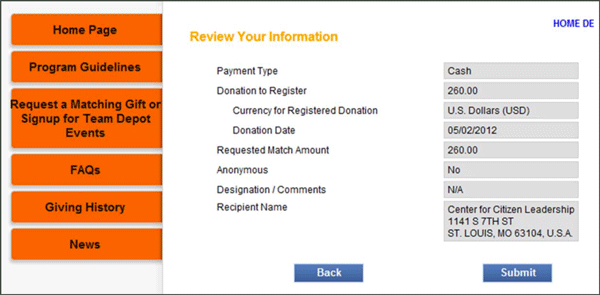

Donors simply have to fill out and submit their employer’s matching gift request forms. However, you need to inform donors of this opportunity first.

How Do I Promote Matching Gifts?

Matching gift request submission deadlines mean little if your organization isn’t informing donors of the opportunity presented to them through matching gift programs. How will a donor know to submit a request on time, if they aren’t aware they’re supposed to submit one in the first place?

Luckily, marketing matching gifts to your donors is easier than ever with the help of matching gift tools. With proper software, you can both inform donors of their match eligibility and provide them with information regarding starting the matching process. When updating your matching gift processes, be sure to consider Double the Donation’s 360MatchPro.

This matching gifts automation software automatically discovers which of your contributors are match-eligible. Then, after identifying these opportunities, the software sends match-eligible donors marketing emails detailing how to begin the gift request process! 360MatchPro is a robust solution, best suited for larger nonprofits looking to improve already-existing processes.

Matching gift deadlines typically fall under one of three types:

- Within a set number of months — A company will stipulate that it will match a gift up to, for example, 3, 6, or 12 months following the initial donation.

- By the end of the calendar year — This option is fairly straightforward. Employees must submit for a match within the calendar year of the donation.

- By the end of the calendar year with an extended grace period — In this instance, a company will grant matched gifts through the end of the calendar year and then tack on an additional month or two for employees to submit their matching gift requests. Standard extensions go through end of January, February, or March, but rarely go past the 31st of March.

To get a better understanding of what the guidelines look like in practice, let’s look at some examples.

Deadline #1: Within a Set Number of Months

While most companies allow donations to be submitted far after the date a donation was made, deadlines do vary. Some major companies have much more time-sensitive deadlines for their matching gift programs.

Here are four companies with matching gift submission deadlines ranging from 30 days to 365 days from the donation date:

Adobe

Adobe offers a matching gift program wherein the company matches donations up to $10,000 per employee per year. Employees are also able to submit grant requests for $250 per every 10 hours they volunteer with a nonprofit.

The company offers an easy to use online portal for employees to submit their matching gift requests and to log their volunteer hours.

Match request deadline: All matching gift requests must be submitted by employees within one year of the donation date.

Click here for additional details on Adobe’s matching gift program.

DirectTV

DirectTV matches donations of up to $20,000 per employee per year and provides grants of $10 per hour (max $250) volunteered by an employee. DirectTV has an easy-to-use online submission process for both programs.

Match request deadline: All matching gift requests must be submitted by employees within six months of the donation date.

Click here for additional details on DirecTV’s matching gift program.

Altria

Altria offers a generous matching gift program (up to 30K annually per Altria employee) as well as large volunteer grants ($500 after 25 hours of volunteering).

Match request deadline: All matching gift requests must be received by Altria’s program administrator within 90 days from the date of the gift.

Click here for additional details on Altria’s matching gift program.

Fannie Mae

Fannie Mae matches employee donations up to $2,500 and offers grants up to $500 when employees volunteer. Unfortunately, some organizations miss out on this funding since they aren’t ensuring donors submit matching gift requests in a timely manner.

Match request deadline: Fannie Mae donors and volunteers must submit a matching gift request within 30 days of the date of the donation, or by December 31st of each year, whichever is sooner.

Click here for additional details on Fannie Mae’s matching gift program.

Deadline #2: End of Calendar Year

Many companies ask that employees submit their match requests in a timely manner but will still match donations made in a calendar year, or by December 31st of that year.

Here are a few examples:

Aetna

Aetna matches donations from employees and retirees up to $5,000 to approved organizations. Aetna also enables employees to allocate a $300 grant to a nonprofit after they volunteer for 20 hours in a year.

Match request deadline: Employees are encouraged to submit the matching gift request as soon as possible but have until December 31st to submit their matching gift requests.

Click here for additional details on Aetna’s matching gift program.

Freeport-McMoRan

Freeport-McMoRan matches donations of up to $40,000 to a wide range of nonprofits. The first $1,000 donated is matched at a 2:1 rate. Anything above $1,000 is matched at a dollar for dollar rate.

Match request deadline: While Freeport-McMoRan encourages employees to submit matching donation requests at the time of the initial donation, employees can submit matches until Dec. 31st of the year following the date of the donation.

Click here for additional details on Freeport-McMoRan’s matching gift program.

Deadline #3: End of Calendar Year + Grace Period

Here are three companies that extend their calendar year deadline with a grace period.

Boeing

Boeing offers a monetary match, a volunteer grant match, and a grant when employees participate in a fundraising event such as a walk or run for a cause. The deadlines for all three of Boeing’s employee giving programs are as follows:

Employee deadline: Boeing employees must submit gift match requests no later than January 31st of the year following the contribution/participation.

Click here for additional details on Boeing’s matching gift program.

Verizon

Verizon matches donations up to $5,000 to educational institutions and up to $1,000 to all other nonprofits.

The Verizon Foundation also provides grants of $750 to organizations where an employee volunteers for at least 50 hours in a calendar year.

Employee deadline: Matching gift requests must be entered into the electronic matching gift system before January 31st of the year following the date of the donation.

Click here for additional details on Verizon’s matching gift program.

Bank of America / Merrill Lynch

Bank of America (including Merrill Lynch) matches employee donations to nearly all nonprofits. The company also provides grants when employees volunteer on a regular basis.

Employee deadline: Employees must complete an application and have the recipient organization verify the gift. This information must be received by January 31st of the year following the date of the donation.

Click here for additional details on Bank of America’s matching gift program.

Dominion Resources, Inc.

Dominion Resources, Inc.

Schneider Electric, Square D NOAD & Subsidiaries

Schneider Electric, Square D NOAD & Subsidiaries Takeda Pharmaceuticals Inc.

Takeda Pharmaceuticals Inc. Novartis International AG

Novartis International AG